As financial planners an integral part of our work with our clients is the production of a lifetime cashflow. This is used to help provide advice in our role as Independent Financial Advisers on investments and pensions.

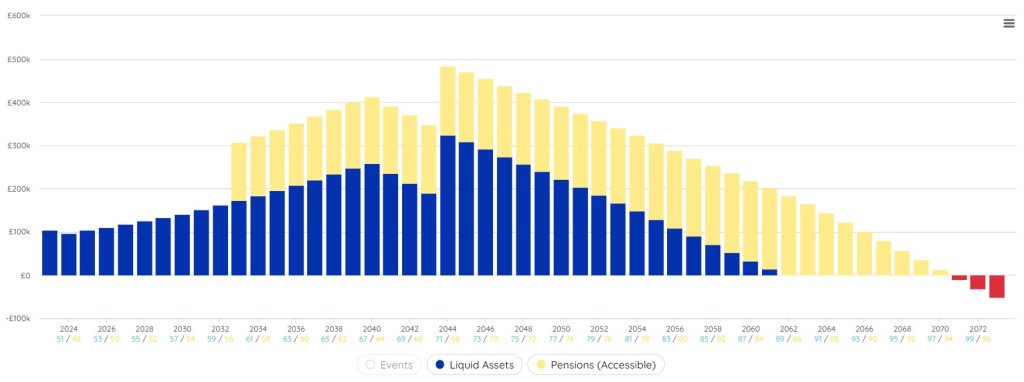

This cashflow takes all our client’s financial data (income, expenditure, assets, liabilities) and projects forward to see what the future might look like using agreed assumptions in areas such as inflation (very topical!), life expectancy and future investment returns. Crucially these assumptions must have the three R’s (reasoned, reasonable and realistic).

In effect, the cashflow is our best guess of the future with what we know today. However, we know the future will not look like the cashflow – life is not a straight line!

What then is the point of the cashflow?

The benefits are:

- It helps us provide appropriate pension and investment advice (what investment return might be needed to avoid running out of money).

- Being able to model the financial impact of a death or disability and provide advice if a shortfall occurs.

- The main benefit, however, is in the minds of our clients – feedback given shows that having a plan provides real peace of mind and can help people enjoy today more knowing they have a plan for the future. I often hear clients say they rarely think about their planning away from our annual meeting – this is great to hear.

- Additionally, being able to show the long term effects of short term negative events is really powerful. Over the past three years we modelled countless times the effect of the sharp fall in investments due to Covid-19 and the ongoing fall in investments in 2022 combined with rising interest rate and inflation. This has proved a real tonic to counteract the continually negative narrative of the mainstream media.

As we always say planning is a process and not an event. Not reviewing a plan is like using a sat-nav which never updates once the journey starts – you might get to your destination, but you might not…

The following extract from Alice in Wonderland is relevant:

Alice: “Would you tell me, please, which way I ought to go from here?”

The Cheshire Cat: “That depends a good deal on where you want to get to.”

Alice: “I don’t much care where.”

The Cheshire Cat: “Then it doesn’t much matter which way you go.”

Alice: “…so long as I get somewhere.”

The Cheshire Cat: “Oh, you’re sure to do that, if only you walk long enough.”

We want our clients to be heading in the right direction and enjoying the journey.

Ongoing planning supported by a lifetime cashflow, evidence-based investments and independent financial advice provides peace of mind and helps our clients focus on what really matters to them in life.

Warm regards

Neil

Neil Rossiter APFS, Chartered MCSI, CFPCM

Chartered & Certified Financial PlannerCM, Chartered Wealth ManagerThis article represents the opinion of W&T Ltd trading as Blackdown financial only and is intended as information only. The content of this article should not be construed as advice or recommendation.